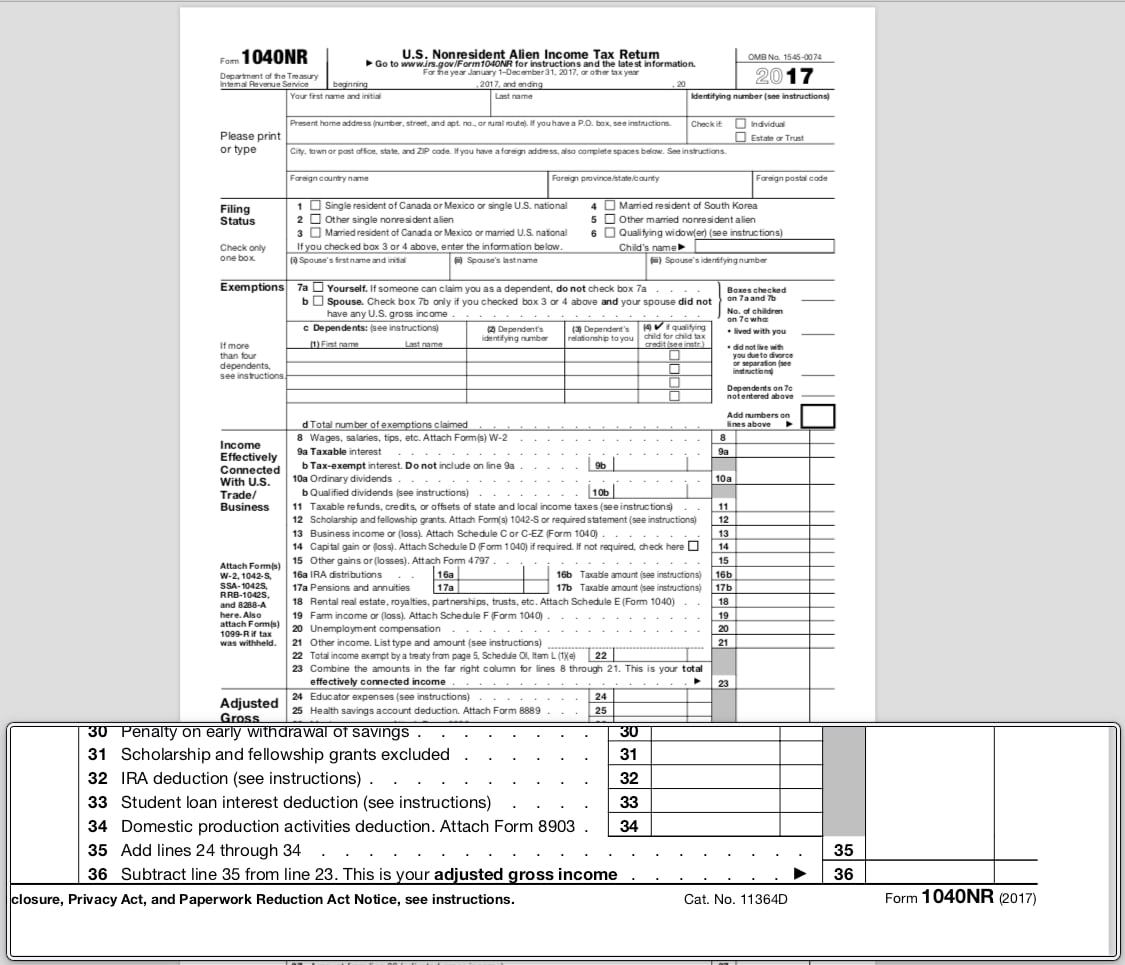

You will still need to keep a copy of your tax reporting documents and tax return for your personal records. If e-filing is available for you, you will not be required to send any hard copy documentation to the IRS to support your federal tax return unless specifically instructed to do so by the Sprintax software. You can learn more about Sprintax's e-filing capabilities, as well as who is eligible to e-file their federal tax returns, on the Sprintax website. All state tax returns will need to be filed in hard copy. Sprintax allows certain eligible nonresidents to e-file their federal tax return only. The IRS recently opened e-filing to Tax Non-Residents. Sprintax will determine if you need to file a Massachusetts tax return, or returns for other states. Do I have to file a Massachusetts State tax return? income is not taxed due to a tax treaty with my country. You must file taxes to determine if you paid too much tax and are due a refund or if you will have to pay additional taxes if the amount withheld was insufficient to meet your tax liability. Do I need to file a tax return if I had taxes withheld from my paychecks? This includes fellowships, stipends, salary, hourly pay, etc. Income generally refers to any money you have received from a U.S. What is considered income for tax purposes? Do I need to file IRS Form 8843 for my U.S. source income, they must also file IRS Form 1040-NR.

What is IRS Form 8843?Īll Tax Non-Residents must file IRS Form 8843 whether or not they had U.S. tax documents if you were not present in the U.S. immigration status other than tourist status (B or ESTA Visa Waiver) in 2022. There is at least one tax form (IRS Form 8843) that you and any dependent family members must file if you held any U.S. Do I Have to File Taxes? What is Considered Income? Do I have to file a tax return?

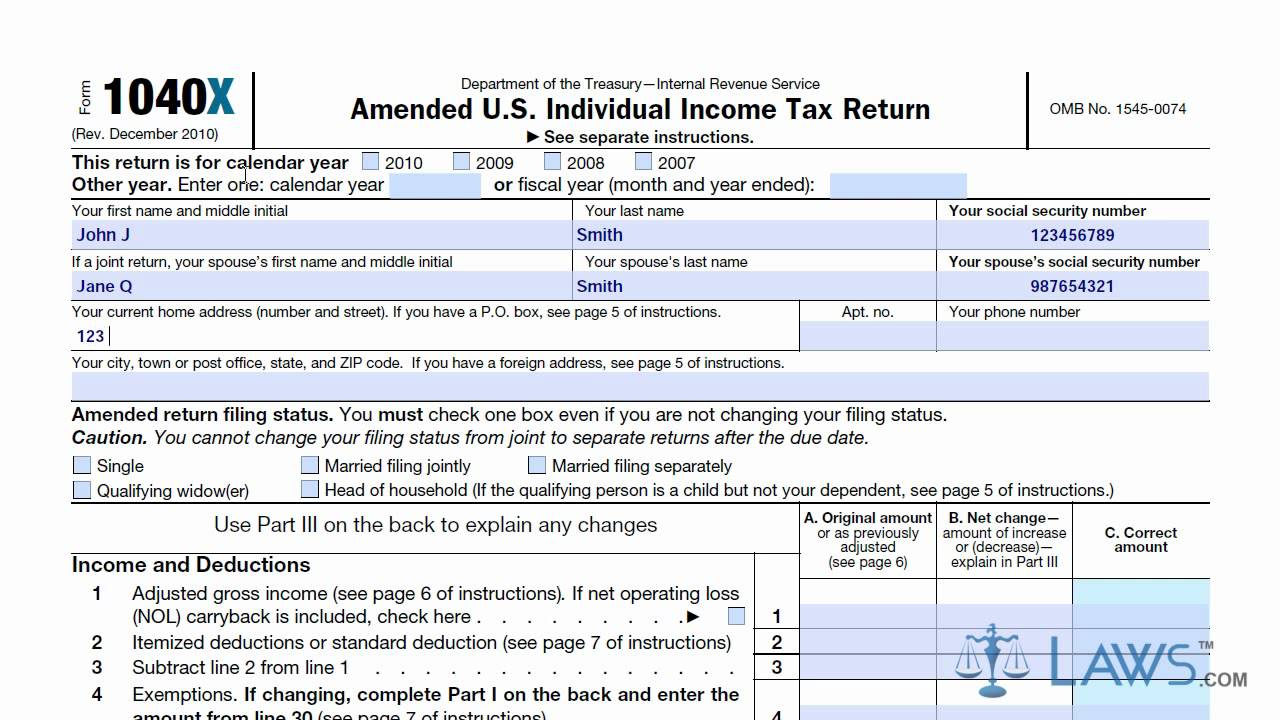

#Turbotax 1040x delayed how to#

To assist you with your tax filing, the HIO will provide you with discounted access to use the Sprintax tax preparation software.įor more information about your tax obligations, how to use Sprintax, and to find additional resources, please see the FAQ below. in 2022 in any immigration status other than B or WT/WB ( ESTA), there is at least one tax form ( IRS Form 8843) that you and any dependent family members must file with the U.S. The following guide has been prepared to help international students and scholars understand their tax responsibilities in the United States (U.S.).

0 kommentar(er)

0 kommentar(er)